- #Venmo transaction history how to#

- #Venmo transaction history full#

- #Venmo transaction history free#

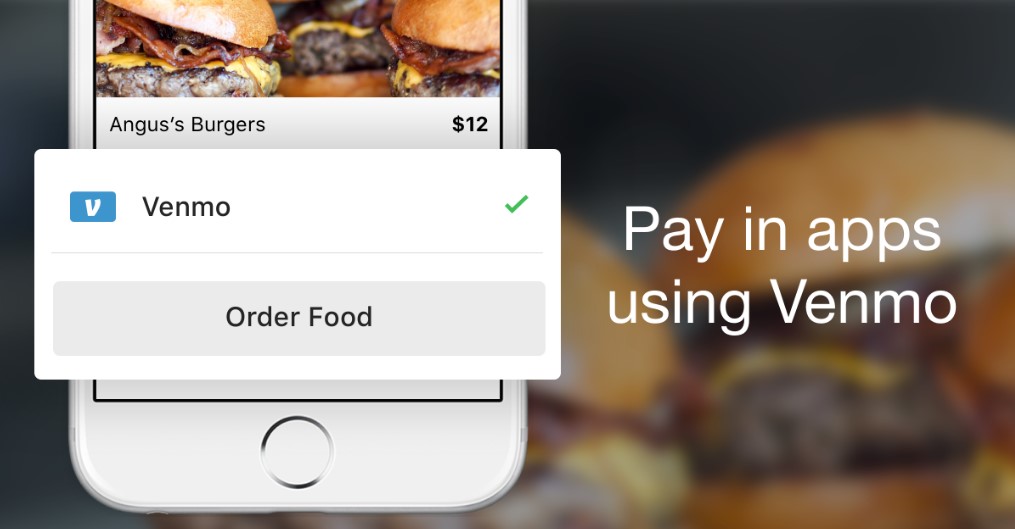

For smaller ticket items, the fees in aggregate can be around half what you get from PayPal. a food cart are much more likely to have Venmo than PayPal - so having Venmo available alongside PayPal and/or your credit card swiper of choice is key. The main difference between Venmo and Paypal for business is that Venmo is intended for smaller ticket items and more casual payments, while PayPal is intended for larger ticket items like invoicing.īoth can be used, but customers in the street at e.g.

#Venmo transaction history full#

*See PayPal Merchant Fees for the full fee structure and withdrawal limits. To help you compare the two, the following table details their most notable differences for business users: Since PayPal owns Venmo and the two have many similarities, you may be wondering why you should choose one over the other. To help you consider your options, the following are the most prominent competitors to Venmo: There are many alternatives to Venmo that could be more appropriate for your business. What are some of the alternatives to Venmo for business? Venmo for business is targeted primarily towards small sole proprietor businesses, including side gigs and registered businesses, but it is also used by large corporations like Hulu, Uber, and Abercrombie & Fitch.Įxamples of users who commonly use Venmo for small business include:

Almost wholly mobile cannot be viewed on a website on your computer.Venmo accepts debit, credit (American Express, Discover, Mastercard, and Visa), and prepaid cards. What are Venmo’s accepted payment methods and payment limits?

However, after your first month, Venmo does charge business profiles a fee of 1.9% + $0.10 per transaction with customers. Also, unlike transfers between personal accounts, payments made by customers to a business profile funded by a credit card are exempt from a 3% fee.

#Venmo transaction history free#

How much does it cost to use Venmo for business?Ĭreating a Venmo business profile is free and there are no monthly fees.

Therefore verifying the recipient is crucial. Keep in mind that Venmo does not have a payment protection program once a payment is sent, you cannot get it back.Do not use Venmo to transact with strangers, especially for sale of goods and services.Nonetheless, Venmo terms of service heavily emphasize the following: Generally speaking, it is no more risky to use Venmo to accept payments than any Point of Sale or other payment processing option having been trusted for $159 Billion total payment volume in 2020, you can be confident in using Venmo for business. Buyers are protected via the Venmo Purchase Program.Business accounts must apply and be explicitly authorized to accept Venmo for purchases of goods and services and.It is equally safe for consumers because: Like other payment processors, Venmo uses encryption to protect and store information and monitors activity to avoid unauthorized transactions. After creating a primary Venmo account, in order to accept business-related payments from customers and keep these payments separate from personal ones, all you’ll have to do is create a business profile. US for-profit businesses can use Venmo to receive money from customers and pay business profiles. Venmo personal accounts are free if money is sent “from a linked bank account, debit card, or your Venmo account,” but there are fees for certain Venmo features. Since adding business features, 2 million merchants now use the Venmo Business service and extra features like direct deposit and debit cards. PayPal acquired Venmo in 2013, and has since grown the app to over 65 million users. Venmo has come a long way since its 2009 launch in New York as an app for splitting the bill at restaurants. What is Venmo? Who is it for and how does it work? What you should know about Venmo and taxes.What to do if you’ve already accepted business-related payments through a personal Venmo account.

#Venmo transaction history how to#

How to integrate Venmo into your business.How to create a Venmo business account and profile.The features, costs, and limits of Venmo and Venmo business Profiles.Pros and Cons of Venmo for business use.

0 kommentar(er)

0 kommentar(er)